Not All Operating Costs Are Entered

Every company needs to manage not only Jobs but also operating costs. It is a great advantage to have everything in one system and have actual compay results immediately available. Often, the compay’s owners and management will learn complete company results only from accountants or by compiling spreadsheets from many sources – all with a significant time lag.

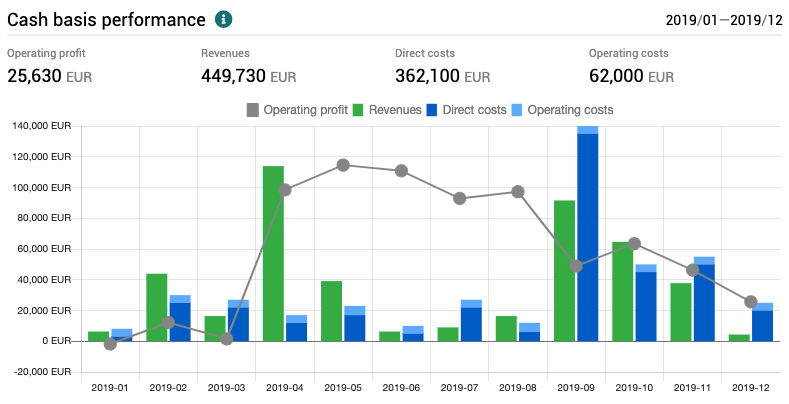

Teamogy offers all this information in one place. However, it is necessary to ensure that all costs are entered into the system, not just the Job-related costs. Otherwise, the system reports a profit that does not correspond to reality and must be constantly refined with the accountants.

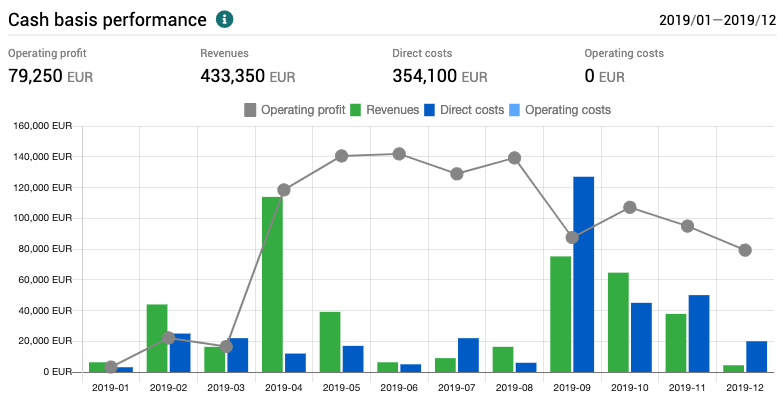

This is an example of an company that doesn’t enter operating costs:

Teamogy allows you to define a clear Internal Overhead structure into which individual operating costs will be matched during the year.

Examples of Internal Overheads structure:

- Office operating costs – rental, equipment, refreshments, etc.

- Personnel costs – employee wages, state contributions, freelancer remuneration

- Technological costs – hardware, software, etc.

- New business costs – travel, refreshment, gifts, etc.

- Self-promotion – web pages, PR articles, competitions, etc.

- Other services – lawyers, etc.

Of course, Internal Overheads contain strict access rules and only authorized people can see their plans and operating costs (supplier invoices). By entering operating costs, you have a detailed view of the company’s profits anytime and anywhere without having to ask anyone.

Get in Touch

If you have problem or need further assistance, do not hesitate contact Teamogy Support. Use online chat (inside Teamogy or everywhere on www.Teamogy.com in the lower right corner) and you will get prompt reply.