About Internal Documents

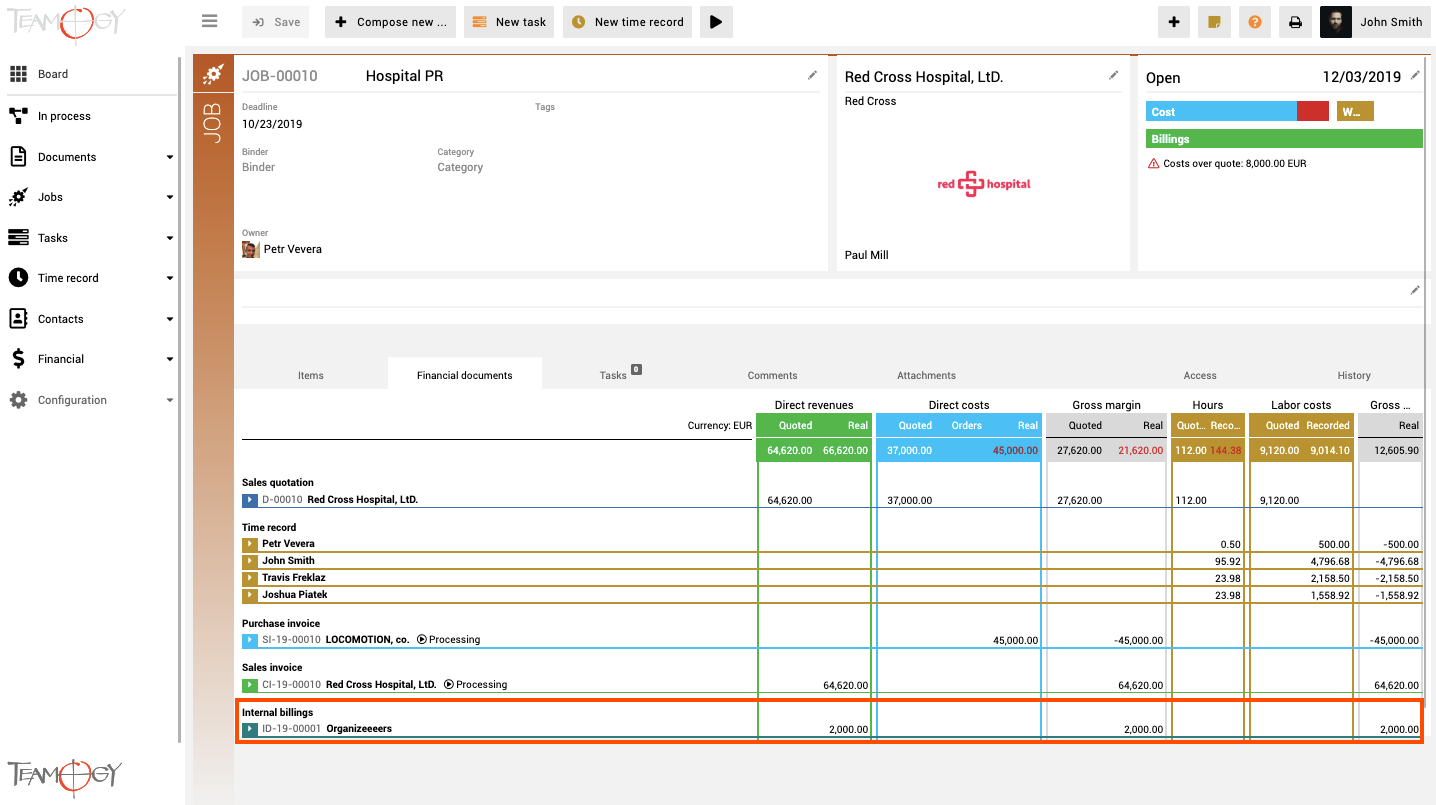

Internal documents are useful if you need to record either Billings or Costs for which you do not have an invoice or other tax documents (e.g. employee salaries, accounting estimates – accrued items, income from insurance incidents, Billings/Cost transfer between Jobs or Overheads). Internal documents financially affect Job or Overhead and act as standard financial documents – Sales or Purchase Invoice.

The companies use these documents in a variety of ways. Therefore you can find two types of Internal Documents in our system: Internal Billings and Internal Costs.

| Internal Billings | are useful if you need to record the billings on the Job or Overhead for which you do not have an invoice or other tax documents (example: income from insurance incident, currency rate differences, and others) or you need to transfer billings between Jobs or Overheads. |

| Internal Costs | are useful if you need to record the costs on the Job or Overhead for which you do not have an invoice or other tax documents (example: employee salaries, depreciation, and others) or you need to transfer costs between Jobs or Overheads. |

Get in Touch

If you have problem or need further assistance, do not hesitate contact Teamogy Support. Use online chat (inside Teamogy or everywhere on www.Teamogy.com in the lower right corner) and you will get prompt reply.