Sales Correction Invoice

Teamogy allows for the creation of a Sales Correction Invoice for your clients. A Sales Correction Invoice is used in the event that you need to modify an already existing Sales Invoice.

In a Sales Correction Invoice, you have three tables. Before Correction, Correction, and After Correction.

What can be modified in the Correction Invoice?

Count & Unit Price. Enter Count, Lower or Raise the price, Teamogy will automatically calculate the correction value & also the value After Correction.

Sales Correction Invoice also meet all legal requirements of your territory:

- VAT rates

- Legal texts

- Numbering sequence (as you wish)

Check the GIF below to see how to create the Sales Correction Invoice.

Sales Correction Invoice works with three table: Before Correction, Correction and After Correction. Let’s take a detail look on these tables.

1. Table – Before Correction, it shows the original Sales Invoice and cannot be edited.

2. Table – Correction is a key table where all corrections of the Sales Invoice are filled in. These corrections include quantity and price. The new total quantity or the new price is not filled in into Correction, but the unit change in price / by how much the quantity has changed compared to the original quantity is recorded. This change can also be a decrease (in the table you enter a number with a minus) of quantity or unit price.

In this table, in the Amount VAT excluded column, the total change in the value of individual items is automatically calculated. This value is calculated as the difference between the total value of the item After Correction and Before Correction (in the table above we can see that Advertising materials and its total amount After Correction is 600 EUR and Before Correction the total amount was 300 EUR, the difference 300 EUR is shown in table – Correction, column Amount VAT excluded)

Let’s look at the examples from the Sales Correction table above, how to fill in the table – Correction.

– Advertising materials were originally invoiced at EUR 2 per unit. The price has changed to 4 EUR, in the table – Correction in the Unit price column we will write the amount of 2 EUR, which represents the difference between the new and the original unit price for the advertising material. (If the price changed to 1 EUR per unit. In the table – Correction we would write -1 EUR)

– The number of leaflets was 300 in their original condition. The new condition is 400 pieces of leaflets. We write this change in the Sales Corrective Invoice in the table – Correction, where we fill in the quantity of 100 pieces in the Count column, which represents the difference between the new and the original state of the number of leaflets. (If the quantity changed to 200 pieces. In the table – Correction we would write -100 pieces)

– The quantity and price of billboards have not changed, so in the table – Corrections we will not fill in anything.

3. Table – After Correction, displays the final status of the Sales Invoice, including changes made from the Sales Correction Invoice. This table cannot be edited.

Here is a sample of what the Sales Correction Invoice looks like:

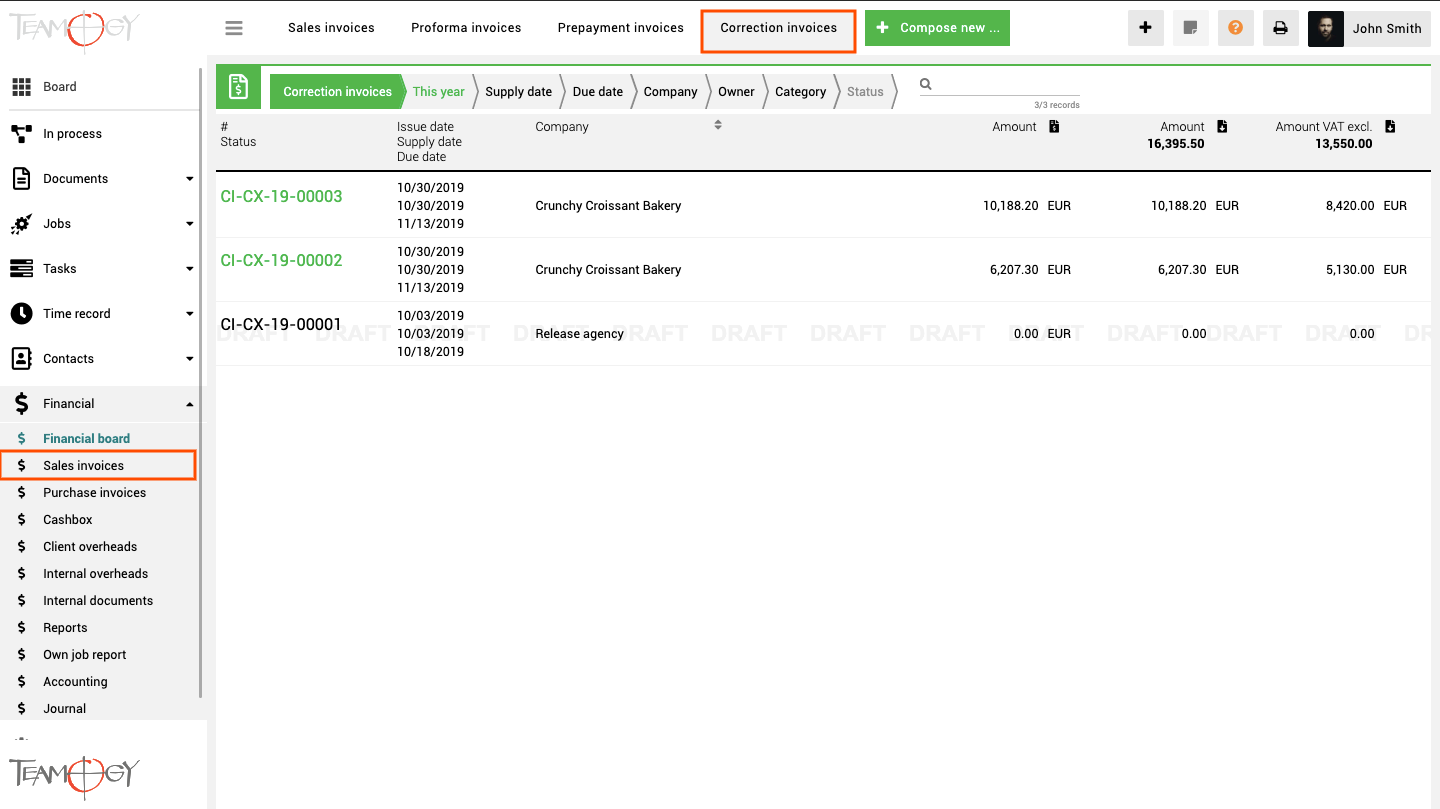

All Sales Correction Invoices can be found in a special tab in Sales invoices.

Get in Touch

If you have problem or need further assistance, do not hesitate contact Teamogy Support. Use online chat (inside Teamogy or everywhere on www.Teamogy.com in the lower right corner) and you will get prompt reply.