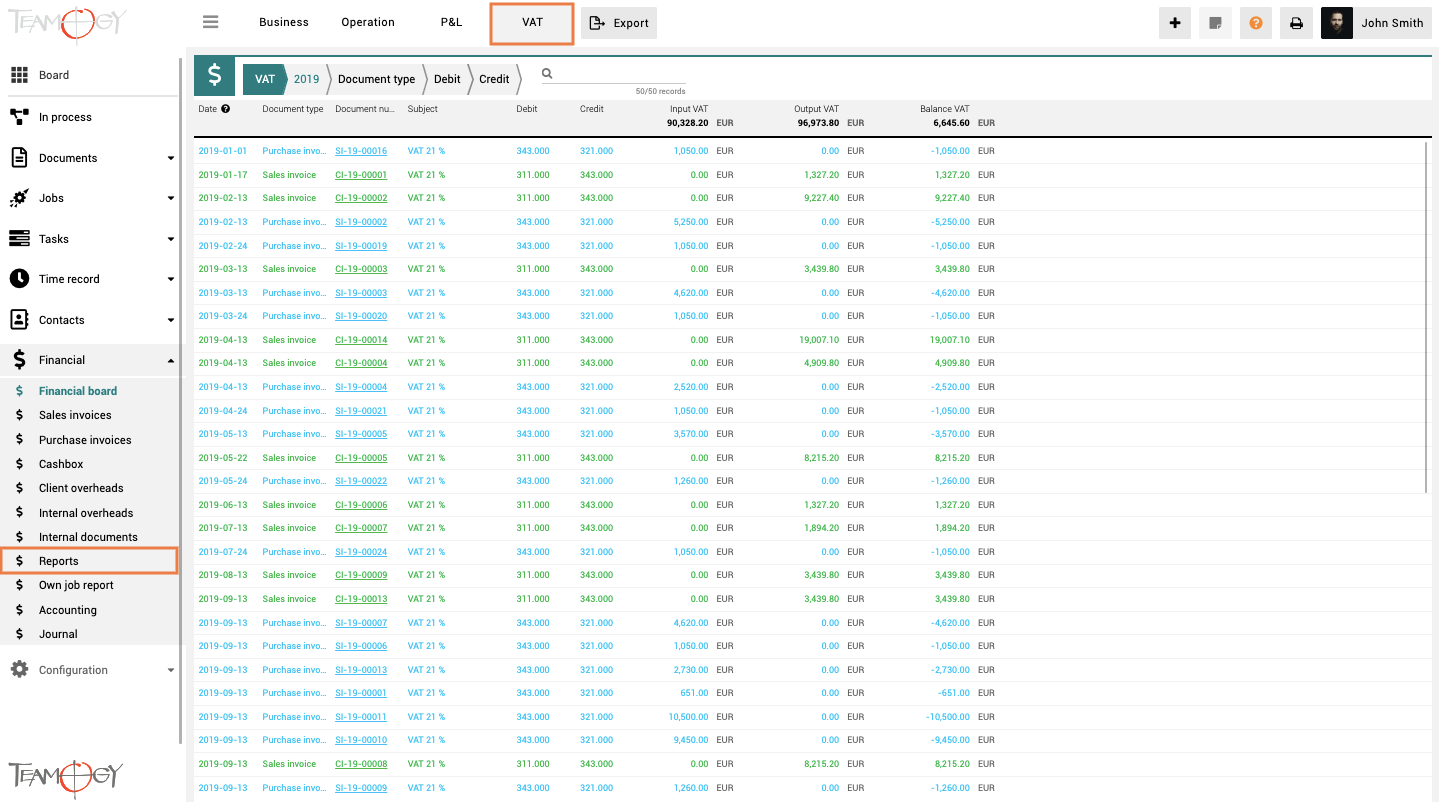

VAT Report

The VAT report shows the VAT values from Sales and Purchase invoices and provides useful information about the amount of the VAT obligation (deduction) for each month.

The VAT report contains the individual financial documents (Sales and Purchase invoices) and the VAT value stated on them. The report shows the VAT balance for the selected time period – whether you will have to pay VAT or if you will be refunded.

| Input VAT | shows the value of VAT on input (Purchase invoice). The entire row is blue. |

| Output VAT | shows the value of VAT on output (Sales invoice). The entire row is green. |

| Balance VAT | is the difference between the Output VAT and the Input VAT. A positive value indicates a surplus of Output VAT. A negative value indicates a surplus of Input VAT. |

Each report allows for easy data filtering. You can easily get a view only of your chosen data.

Get in Touch

If you have problem or need further assistance, do not hesitate contact Teamogy Support. Use online chat (inside Teamogy or everywhere on www.Teamogy.com in the lower right corner) and you will get prompt reply.